10 Ways How Women Manage Money in Relationships

How Women Manage Money in Relationships often involves open communication, setting shared financial goals, and maintaining a balance between independence and partnership.

How Women Manage Money in Relationships often involves open communication, setting shared financial goals, and maintaining a balance between independence and partnership.

Money can be one of the most significant sources of tension in relationships, but it can also be an opportunity for growth, teamwork, and open communication.

Modern women are increasingly taking charge of their financial future—whether they’re single or in relationships. When it comes to managing finances within a partnership, it’s crucial to strike a balance between independence and unity.

Navigating the complexities of money in a relationship requires clear communication, mutual respect, and an understanding of shared and individual financial goals.

In today’s world, women are no longer just relying on their partners for financial support. They are equal contributors, decision-makers, and co-planners when it comes to budgeting, saving, investing, and spending. This shift in financial dynamics requires new strategies for couples to manage their cash flow and ensure both partners are on the same page.

Table of Contents

Money Freedom Tools

Below are some to the financial freedom tools that will help in developing your financial freedom either by properly creating a budget that works for your personal style. It also includes the different strategies that will ensure your retirements goals are achievable.

Financial Budget Planner

Financial Budget Planner

It has many financial tips, trackers and and strategies to implement along the way.

- Home Finance and Bill Payment Organizer

- Budgeting Book with Income and Expense Tracker

- Daily, weekly, monthly and yearly budgets

- Has spacious pocket for all your bills, set annual financial goals, build a viable strategy,

.

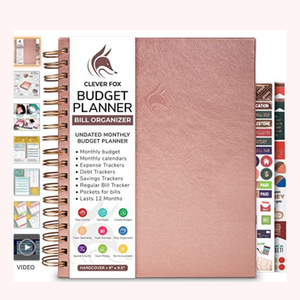

Budget Planner

Budget Planner

This is a comprehensive budget planner that is aimed in saving money and repaying debt fast

- Monthly bill organizer with pockets

- Expense tracker and finance journaling

- Financial calendar tracks money & savings,

- Debt tracking, Payment, Balances

- Bill tracking, and 2 pages for annual

.

Personal Finance Book

Personal Finance Book

This book showcases how to completely transform your finances by showing step by step strategies

- Simplified beginners guide to eliminate financial stress

- Comes with digital simplified templates to use

- Saving strategies that can quickly save money

- Debt paying strategies that will erase debt faster

- Easy Strategies to implement and track your progress

.

Payoff Debt Fast

Payoff Debt Fast

This book showcases the best way to quickly erase different types of debts.

- How to correctly payoff debt and correctly borrow money

- Includes how to manage different types of interest rates

- Credit Scores, Student Loans, Debt Payoff Strategies

- Cheaply manage debt, Essential Primer on Managing Debt

- Use credit wisely with this easy-to-understand, comprehensive guide

.

1. Open Conversations About Money

The foundation of any successful relationship—especially when it comes to finances—is communication. Many couples avoid talking about money, but avoiding the topic can lead to misunderstandings, resentment, and financial stress. Modern women understand the importance of having open, honest conversations about money with their partners.

Discussing finances early on can help couples align their financial goals, understand each other’s spending habits, and work together to create a financial plan. Women are often the ones who initiate these conversations, recognizing the power of transparency and mutual understanding. By discussing everything from income and savings goals to debt and credit scores, couples can build trust and make informed decisions together.

Tip: Set aside time for regular financial check-ins to discuss your goals, budgets, and any challenges you’re facing. This will help keep both partners on track and avoid any surprises.

2. Shared vs. Separate Finances

One of the most common questions couples face is whether to keep their finances separate or combine everything into one joint account. There’s no one-size-fits-all answer, as every couple’s situation is unique. Some modern women choose to maintain separate accounts for personal spending, while others prefer pooling their resources into a joint account for shared expenses.

The key is finding a system that works for both partners. In some relationships, having separate accounts allows for more autonomy and less conflict over spending. In others, a joint account fosters a sense of unity and shared responsibility. Some couples even opt for a hybrid approach, where they maintain individual accounts but also contribute to a joint account for shared expenses such as rent, utilities, and groceries.

Tip: Have an open discussion about which approach works best for both of you. It’s essential that both partners feel comfortable and respected in the financial arrangement.

3. Balancing Financial Power Dynamics

In many relationships, there can be an imbalance in financial power. Whether due to one partner earning more or having more financial knowledge, it’s important for modern women to address these power dynamics early on. Financial independence is crucial, but so is ensuring that both partners have an equal say in decision-making.

One of the ways modern women handle this is by ensuring they have access to financial information and actively participate in financial discussions. Whether it’s budgeting, investing, or saving for future goals, it’s important that both partners feel their contributions are valued. Women today are more likely than ever to take the lead in financial decisions, from setting up retirement accounts to managing shared expenses.

Tip: Both partners should be actively involved in financial planning. Don’t shy away from discussing financial matters, even if one partner handles the finances more frequently. Equal participation fosters a sense of fairness and partnership.

4. Saving for the Future Together

For many couples, saving for the future is one of the most important financial goals. Whether it’s building an emergency fund, saving for a down payment on a house, or contributing to retirement accounts, couples need to plan for the long term. Modern women are more likely to take charge of this process, ensuring that both partners are contributing to their shared financial future.

It’s crucial to set mutual goals and make a plan for how to achieve them. This might involve setting up automatic transfers to savings accounts, cutting back on unnecessary expenses, or finding new ways to increase income. Women are increasingly prioritizing financial independence within relationships, ensuring that they’re not solely dependent on their partner for financial security.

Tip: Set both short-term and long-term financial goals together, such as saving for a vacation or creating a retirement fund. Regularly check in on your progress and adjust your strategies if needed.

5. Managing Debt as a Couple

Debt can be a major stressor in relationships, especially when one partner has more debt than the other. Modern women are taking steps to address this challenge head-on by being transparent about their debt and working together to pay it off. Whether it’s student loans, credit card debt, or a mortgage, it’s important for both partners to have a clear understanding of each other’s financial obligations.

Couples can work together to create a strategy for paying off debt, which might include refinancing loans, consolidating debt, or simply prioritizing high-interest loans. Women today are more likely to take an active role in managing debt repayment, advocating for financial equality within the partnership.

Tip: Create a debt repayment plan together, prioritizing the highest-interest debts first. Celebrate small wins along the way to stay motivated.

6. Investing for the Future

Investing has traditionally been seen as a male-dominated area, but modern women are changing that. Many women are now taking charge of their investment strategies, whether it’s through stocks, real estate, or retirement accounts. Women recognize the importance of building wealth over time and are becoming more financially literate to make informed investment choices.

Investing together as a couple can be an empowering experience, and it’s essential for both partners to understand how investments align with their financial goals. Whether you’re saving for retirement or building a portfolio, discussing your investment strategy openly and making decisions together strengthens your financial bond.

Tip: Educate yourself on investment options and consider working with a financial advisor to create an investment strategy that aligns with your long-term goals.

7. Handling Financial Conflicts

Even the most financially savvy couples can face disagreements about money. Whether it’s different spending habits, conflicting priorities, or differing money philosophies, financial conflicts can strain a relationship. Modern women are more likely to approach these conflicts with a problem-solving mindset rather than avoiding or ignoring the issue.

It’s important to address conflicts head-on and focus on finding solutions that work for both partners. Open, non-judgmental communication is key to resolving financial disputes. Many couples find it helpful to set up regular financial check-ins to discuss any concerns and make adjustments as needed.

Tip: When conflicts arise, remain calm and try to approach the issue from a place of understanding. Work together to find common ground and compromise where necessary.

8. Setting Financial Boundaries

Setting financial boundaries is essential in any relationship. It’s important to have personal financial goals and the freedom to manage your money independently while also contributing to joint goals. Modern women are setting clear boundaries around their personal finances, whether it’s setting limits on how much they spend individually or maintaining control over their own investments.

Setting boundaries also means respecting each other’s financial priorities and not pressuring each other into spending or saving in ways that don’t align with your individual values. Boundaries help couples respect each other’s financial independence while still working toward shared objectives.

Tip: Be clear about your financial boundaries and communicate them respectfully. This can help prevent unnecessary tension and ensure both partners feel in control of their money.

9. Planning for Major Life Events

Major life events—such as getting married, having children, buying a house, or starting a business—require significant financial planning. Modern women are taking a proactive approach to these life transitions by planning ahead and ensuring that both partners are aligned on their financial priorities.

Whether you’re planning for a wedding, starting a family, or purchasing your first home together, it’s crucial to have a solid financial plan that accounts for both short-term and long-term costs. Women are more likely than ever to take the lead in financial planning during these major life events, ensuring that they’re prepared for any challenges that may arise.

Tip: Plan ahead for major life events by creating a detailed budget and saving in advance. This will help reduce stress and ensure a smooth transition when the time comes.

Conclusion

In today’s world, how modern women handle money handle money in relationships are no longer passive participants in their financial relationships. They are taking the reins, making informed decisions, and working with their partners to build a secure, prosperous future together. By fostering open communication, setting clear financial goals, and respecting each other’s financial independence, couples can create a harmonious financial partnership.

Money doesn’t have to be a source of conflict—it can be an opportunity for growth, teamwork, and shared success. As women continue to take charge of their financial futures, they’re setting the stage for healthier, more empowered relationships. Whether you’re navigating shared expenses, managing debt, or planning for the future, remember that financial success is a journey that you and your partner can take together, as a team.

- 100 Valentine Lovers Questions - February 24, 2025

- 2025 New Year Growth Quotes - February 24, 2025

- 2025 Inspiring Self Love Quotes - February 24, 2025