15 Best Beginner’s Financial Freedom Guide

A Beginner’s Financial Freedom Guide starts with mastering budgeting, saving, and investing to create a life of stability and endless possibilities.

A Beginner’s Financial Freedom Guide starts with mastering budgeting, saving, and investing to create a life of stability and endless possibilities.

Investing is no longer a man’s game—women are stepping into the financial arena with confidence, determination, and a keen sense of purpose.

Yet, many women hesitate to take that first step towards investing, often due to a lack of knowledge or fear of the unknown.

The truth is, investing isn’t just about growing your wealth; it’s about empowering yourself, securing your future, and creating opportunities for financial freedom.

Best course of action is to figure out exactly what you want your financially world to be like, is paying off debt, learning a new skill, increase income and so forth.

You are the best financial advisor of your money, the only difference is creating a plan, learning and being flexible.

Table of Contents

Favorite Money Tools

Money tools can help you take control of your finances and build a secure future. Budgeting apps like Mint or YNAB make it easy to track spending and set savings goals. Below are some of our favorite easy to use money tools

Budget Planner

Budget Planner

This is a comprehensive budget planner that is aimed in saving money and repaying debt fast

- Monthly bill organizer with pockets

- Expense tracker and finance journaling

- Financial calendar tracks money & savings,

- Debt tracking, Payment, Balances

- Bill tracking, and 2 pages for annual

Personal Finance Book

Personal Finance Book

This book showcases how to completely transform your finances by showing step by step strategies

- Simplified beginners guide to eliminate financial stress

- Comes with digital simplified templates to use

- Saving strategies that can quickly save money

- Debt paying strategies that will erase debt faster

- Easy Strategies to implement and track your progress

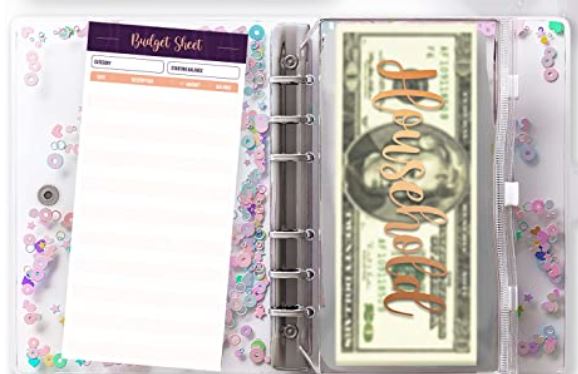

Cash Method Binder

Cash Method Binder

- This cash binder is great for cash budgeting method Can easily use the cash method

- Can easily organize track your cash

- 10 Gold Vinyl Printed Sticker

- Quality PVC, leaf pockets tear resistant, waterproof

.

1. Start with a Mindset of Abundance

Your journey to financial freedom starts with your mindset. Many are conditioned to think about money in terms of scarcity—saving every penny and avoiding risks. Shift your mindset to one of abundance, where money is a tool for growth. Believe that you’re capable of making smart investment decisions. A positive mindset lays the foundation for confident and strategic investing.

2. Educate Yourself About Investing

Knowledge is power, and understanding the basics of investing is essential. Learn about different investment options such as stocks, bonds, mutual funds, and real estate. Explore resources like books, podcasts, and online courses tailored for beginners. The more you know, the more empowered you’ll feel to make informed decisions. Start small and build your knowledge over time—it’s an investment in itself.

3. Set Clear Financial Goals

Before you start investing, define your financial goals. Are you saving for a dream home, retirement, your child’s education, or simply aiming for financial independence? Clear goals will guide your investment strategy and help you stay focused. Break them down into short-term, medium-term, and long-term objectives. Having a roadmap makes it easier to track your progress and celebrate milestones.

4. Create a Budget and Save for Investing

Investing requires capital, and the first step is creating a budget that allows you to save. Analyze your income and expenses, and identify areas where you can cut back. Redirect those savings into an investment fund. Even small amounts can add up over time, so start with whatever you can afford. Consistent saving is the first step towards building a strong investment portfolio.

5. Build an Emergency Fund First

Before diving into investments, ensure you have an emergency fund in place. This fund should cover at least three to six months’ worth of living expenses. An emergency fund acts as a safety net, allowing you to invest with confidence, knowing you’re prepared for unexpected situations. Without this, you might be forced to liquidate your investments prematurely.

6. Start Small with Low-Risk Investments

If you’re a beginner, start with low-risk investment options such as index funds or government bonds. These provide steady returns and are less volatile compared to individual stocks. Starting small allows you to learn without feeling overwhelmed. As you become more comfortable, you can diversify your portfolio with higher-risk, higher-reward investments.

7. Leverage Employer-Sponsored Retirement Plans

If your employer offers a retirement plan like a 401(k), take full advantage of it, especially if they match your contributions. Employer-sponsored plans are a great way to start investing with minimal effort, and the tax benefits make them even more attractive. Contribute as much as you can afford—future you will thank you.

8. Diversify Your Investments

The golden rule of investing is diversification. Don’t put all your eggs in one basket. Spread your investments across different asset classes, industries, and geographic regions. Diversification minimizes risk and ensures that your portfolio remains stable even if one sector underperforms. Think of it as a way to balance security and growth.

9. Understand the Power of Compounding

One of the most exciting aspects of investing is the power of compounding. This is when your earnings generate additional earnings over time. For example, dividends or interest earned on your investments get reinvested, leading to exponential growth. The earlier you start investing, the more you can benefit from compounding. Time is your greatest ally in building wealth.

10. Don’t Let Fear Hold You Back

Fear of losing money is one of the biggest barriers to investing, especially for women. While it’s natural to feel apprehensive, remember that every successful investor started somewhere. Understand that risk is part of the process, and not all investments will yield high returns. Focus on the bigger picture and embrace the learning curve. Confidence comes with experience.

11. Seek Professional Advice When Needed

If you’re unsure about where to start, consider consulting a financial advisor. A professional can help you create a personalized investment plan based on your goals, risk tolerance, and financial situation. Look for advisors who understand your unique needs and are committed to empowering women. Investing is a team sport, and expert guidance can make a big difference.

12. Explore Real Estate Investments

Real estate is a popular and effective way to build wealth. Whether it’s buying rental properties, investing in real estate funds, or flipping houses, there are plenty of options to explore. Real estate offers both steady income and long-term appreciation. Do your research, understand the market, and start small if needed. It’s a tangible way to grow your portfolio.

13. Join Investment Communities for Women

Many women are finding success by joining investment communities that cater to their unique needs. These groups provide a safe space to share experiences, ask questions, and learn from others. Whether online or in-person, these communities can help you stay motivated, gain new insights, and build a network of like-minded women.

14. Monitor and Adjust Your Portfolio Regularly

Investing isn’t a “set it and forget it” process. Regularly review your portfolio to ensure it aligns with your goals and the current market conditions. Rebalance as needed to maintain your desired level of risk and diversification. Staying engaged with your investments helps you stay on track and adapt to changes in your financial landscape.

15. Celebrate Your Financial Wins

Every step you take towards financial freedom is worth celebrating. Whether it’s opening your first investment account, reaching a savings milestone, or earning your first dividends, take the time to acknowledge your progress. Celebrating your wins boosts your confidence and keeps you motivated to achieve even bigger goals.

Conclusion

Investing isn’t just about money—it’s about empowerment, independence, and creating a future you’re excited about. By taking control of your finances and learning how to invest, you’re breaking barriers and setting yourself up for success.

Remember, it’s never too late to start investing, and every small step counts. Approach your financial journey with curiosity, confidence, and a commitment to growth. The path to financial freedom is within your reach—invest like the queen you are and watch your empire flourish.

- 100 Valentine Lovers Questions - February 24, 2025

- 2025 New Year Growth Quotes - February 24, 2025

- 2025 Inspiring Self Love Quotes - February 24, 2025