10 Best Investing Tools and Resources

Investing Tools and Resources include online platforms, financial advisors, and educational tools that simplify investing and empower informed decision-making.

Investing Tools and Resources include online platforms, financial advisors, and educational tools that simplify investing and empower informed decision-making.

Investing used to be a male-dominated field, but times are changing, and more women are taking charge of their financial futures.

Women today are increasingly stepping into the world of investing, aiming to build wealth, secure their futures, and support their financial independence.

With more resources available than ever, there’s no reason for women to shy away from the stock market, real estate, or other investment opportunities. Whether you’re a beginner or an experienced investor, the right tools and resources can help you grow your wealth intelligently and confidently.

Let’s explore the best tools and resources that women can use to start or enhance their investment journey. From user-friendly platforms to educational content, there are countless options available to help women gain financial freedom and achieve their long-term goals. Let’s dive into some of the top tools and resources that can empower you to become a successful investor.

Table of Contents

Money Freedom Tools

Below are some to the financial freedom tools that will help in developing your financial freedom either by properly creating a budget that works for your personal style. It also includes the different strategies that will ensure your retirements goals are achievable.

Financial Budget Planner

Financial Budget Planner

It has many financial tips, trackers and and strategies to implement along the way.

- Home Finance and Bill Payment Organizer

- Budgeting Book with Income and Expense Tracker

- Daily, weekly, monthly and yearly budgets

- Has spacious pocket for all your bills, set annual financial goals, build a viable strategy,

.

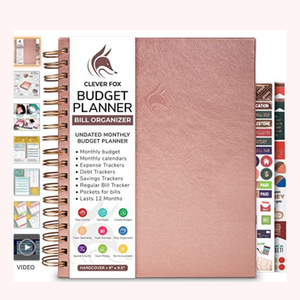

Budget Planner

Budget Planner

This is a comprehensive budget planner that is aimed in saving money and repaying debt fast

- Monthly bill organizer with pockets

- Expense tracker and finance journaling

- Financial calendar tracks money & savings,

- Debt tracking, Payment, Balances

- Bill tracking, and 2 pages for annual

.

Personal Finance Book

Personal Finance Book

This book showcases how to completely transform your finances by showing step by step strategies

- Simplified beginners guide to eliminate financial stress

- Comes with digital simplified templates to use

- Saving strategies that can quickly save money

- Debt paying strategies that will erase debt faster

- Easy Strategies to implement and track your progress

.

Payoff Debt Fast

Payoff Debt Fast

This book showcases the best way to quickly erase different types of debts.

- How to correctly payoff debt and correctly borrow money

- Includes how to manage different types of interest rates

- Credit Scores, Student Loans, Debt Payoff Strategies

- Cheaply manage debt, Essential Primer on Managing Debt

- Use credit wisely with this easy-to-understand, comprehensive guide

.

1. Robo-Advisors: A Hands-Off Approach to Investing

For women who may not have the time or expertise to manage their investments actively, robo-advisors offer a fantastic solution. These automated platforms provide personalized investment management based on your financial goals, risk tolerance, and time horizon. Robo-advisors are ideal for those who want to invest without the constant need for research and analysis.

Some popular robo-advisors include Betterment,or Wealthfront,—the latter specifically designed with women in mind. Ellevest takes a holistic approach to financial planning, offering investment strategies tailored to women’s unique financial needs, such as longer life expectancies and pay gaps. These platforms typically offer low fees, diversification, and automatic rebalancing, making them an accessible entry point for new investors.

Tip: If you’re new to investing, start with a robo-advisor to learn the basics and enjoy a hands-off approach while building your wealth over time.

2. Investment Apps: Easy Access to the Stock Market

Investment apps have become increasingly popular among women who want to take control of their investments while on the go. These apps allow you to buy and sell stocks, bonds, exchange-traded funds (ETFs), and more, all from your smartphone. Many of these apps also offer educational tools, making it easier to understand the ins and outs of investing.

Some of the best investment apps for women such as Stash. Robinhood is known for its commission-free trading, while Acorns helps you invest spare change by rounding up your purchases and investing the difference. Stash offers personalized advice and pre-made investment portfolios for those who want to start small and grow their investments gradually.

Tip: Choose an investment app that aligns with your financial goals and investing style. Many apps have low minimum investment requirements, making it easy to start with a small amount of money.

3. Online Brokerage Accounts: Customizable Investment Portfolios

For those who are ready to take a more hands-on approach, an online brokerage account can be the perfect tool. These accounts give you access to a wide range of investment products, from stocks and bonds to mutual funds and ETFs. Unlike robo-advisors, online brokerage accounts allow you to choose your investments and manage them yourself.

Fidelity, and TD Ameritrade are excellent online brokerage platforms that offer low fees, robust research tools, and educational resources. These platforms give you complete control over your investments, which is ideal for women who want to take a proactive role in managing their portfolios. Many brokerage accounts also offer retirement accounts such as IRAs, which are essential for long-term wealth building.

Tip: If you have the time and interest to manage your investments directly, consider opening an online brokerage account. Make sure to take advantage of the educational tools these platforms offer to improve your investing knowledge.

4. Financial Planning Software: A Comprehensive Approach to Wealth Management

For women who want a more comprehensive approach to their finances, financial planning software is an excellent resource. These tools offer a holistic view of your financial situation, including your investments, savings, retirement accounts, and debts. Financial planning software can help you create a personalized roadmap for your financial future, ensuring that you’re on track to meet your wealth-building goals.

YNAB (You Need a Budget) is perfect for financial planning. YNAB focuses on helping you budget effectively, giving you more control over your spending and savings.

Tip: Use financial planning software to track all aspects of your financial life, including your investments, retirement goals, and monthly budget. This will help you make informed decisions and stay on track with your wealth-building plan.

5. Real Estate Investment Platforms: Diversifying Your Portfolio

While traditional stocks and bonds are popular investment options, real estate is another great way to diversify your portfolio and build long-term wealth. Real estate investing allows you to invest in properties or real estate funds without the hassle of property management.

Fundrise and Roofstock are two platforms that allow women to invest in real estate with relatively low capital requirements. Fundrise offers a variety of real estate investment funds that focus on commercial and residential properties, while Roofstock allows you to invest in single-family rental properties. These platforms make real estate investing accessible to individuals who may not have the resources to buy properties outright.

Tip: If you’re looking for a way to diversify your investment portfolio, consider real estate investing through online platforms like Fundrise or Roofstock.

6. Investment News and Resources: Staying Informed About the Market

Being well-informed is essential for making smart investment decisions. Keeping up with the latest market news and trends can help you stay ahead of the curve and make timely, educated choices. Many women who invest rely on a variety of resources to stay informed, from market news websites to financial podcasts.

Some great sources of investment news and education include CNBC, Investopedia . These websites provide valuable resources for learning about the stock market, individual investments, and general financial strategies. Women can also take advantage of financial podcasts like “The Indicator from Planet Money” and “She’s on the Money,” which offer bite-sized, digestible financial advice.

Tip: Stay up to date with the latest financial news and trends by subscribing to financial blogs, podcasts, or newsletters. This will help you make informed decisions about your investments.

7. Financial Podcasts: Learning on the Go

Podcasts are a convenient way to learn about investing and personal finance while on the go. Whether you’re commuting, exercising, or doing household chores, you can easily tune into a financial podcast to learn more about wealth-building strategies.

Some of the best financial podcasts for women include “She’s on the Money”, “The Financial Confessions”, and “Money Girl’s Quick and Dirty Tips for a Richer Life”. These podcasts cover a range of topics, from investing and budgeting to saving for retirement and managing debt. Many of these shows feature interviews with financial experts and offer actionable tips that can help you grow your wealth.

Tip: Set aside time each week to listen to a financial podcast to enhance your financial literacy and stay motivated on your wealth-building journey.

8. Financial Advisors and Coaches: Personalized Advice

If you’re looking for personalized guidance on your investment journey, working with a financial advisor or coach can be incredibly valuable. Financial advisors offer tailored advice based on your individual financial goals, risk tolerance, and overall financial situation. Many advisors specialize in helping women make smarter investment decisions and plan for their futures.

Ellevest, a robo-advisor designed for women, also offers access to financial advisors who can help with specific financial goals. Additionally, some women prefer to work with financial coaches who specialize in women’s financial empowerment, helping them overcome limiting beliefs and take control of their financial futures.

Tip: If you need personalized advice, consider working with a financial advisor or coach. They can help you create a comprehensive strategy for your investments and overall financial plan.

Conclusion

Investing is no longer a realm reserved solely for men—it’s a powerful tool that women can use to build wealth, achieve financial independence, and secure their futures. With the right tools and resources, women can confidently take control of their finances and build portfolios that reflect their values and goals. From robo-advisors and investment apps to financial podcasts and real estate platforms, there are plenty of options available to women looking to grow their wealth.

By utilizing these resources, women can learn, invest, and thrive in the financial world. Whether you’re just starting out or are looking to enhance your existing portfolio, remember that the key to financial success lies in educating yourself, staying informed, and seeking help when needed. Take the first step today and empower yourself to invest like a pro.

- 100 Valentine Lovers Questions - February 24, 2025

- 2025 New Year Growth Quotes - February 24, 2025

- 2025 Inspiring Self Love Quotes - February 24, 2025