10 Money Rules Every Woman Should Break

Money Rules Every Woman Should Break include outdated notions like avoiding investment risks or relying solely on traditional savings accounts for financial growth.

Money Rules Every Woman Should Break include outdated notions like avoiding investment risks or relying solely on traditional savings accounts for financial growth.

For generations, women have been conditioned to follow traditional money rules that often limit their financial potential. These rules, steeped in outdated societal norms, were never designed with modern women in mind.

Today, women are redefining success, taking charge of their finances, and breaking free from the shackles of convention.

It’s time to revolutionize the way we think about money. By challenging these outdated rules, women can embrace financial freedom, grow their wealth, and lead lives of abundance and empowerment. Let’s explore the 10 money rules every woman should break and why doing so is the key to financial independence.

Table of Contents

Favorite Money Tools

Money tools can help you take control of your finances and build a secure future. Budgeting apps like Mint or YNAB make it easy to track spending and set savings goals. Below are some of our favorite easy to use money tools

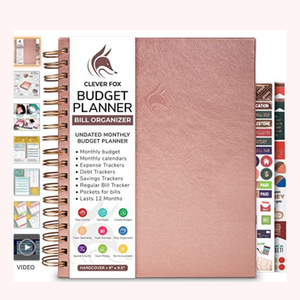

Budget Planner

Budget Planner

This is a comprehensive budget planner that is aimed in saving money and repaying debt fast

- Monthly bill organizer with pockets

- Expense tracker and finance journaling

- Financial calendar tracks money & savings,

- Debt tracking, Payment, Balances

- Bill tracking, and 2 pages for annual

Personal Finance Book

Personal Finance Book

This book showcases how to completely transform your finances by showing step by step strategies

- Simplified beginners guide to eliminate financial stress

- Comes with digital simplified templates to use

- Saving strategies that can quickly save money

- Debt paying strategies that will erase debt faster

- Easy Strategies to implement and track your progress

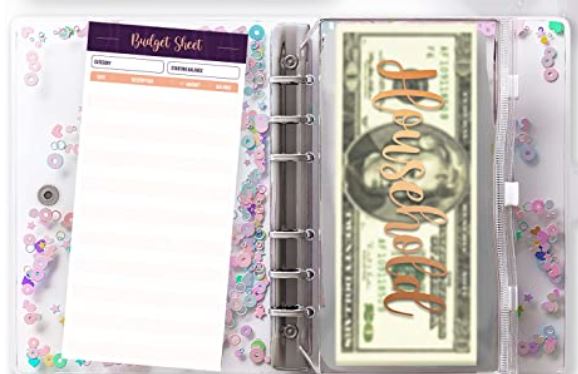

Cash Method Binder

Cash Method Binder

- This cash binder is great for cash budgeting method Can easily use the cash method

- Can easily organize track your cash

- 10 Gold Vinyl Printed Sticker

- Quality PVC, leaf pockets tear resistant, waterproof

.

1. “Save Every Penny; Don’t Spend on Yourself”

For too long, women have been told to prioritize saving over spending on themselves. While saving is important, denying yourself the things that bring joy and enhance your life isn’t the answer. Investing in personal growth, education, or even a well-deserved treat can be just as valuable as saving. You can strike a balance between managing your finances responsibly and enjoying the fruits of your labor.

2. “Leave Investing to the Experts”

There’s a pervasive myth that women aren’t naturally inclined toward investing and should leave it to professionals—or worse, to their partners. This couldn’t be further from the truth. Women are excellent investors, often making more calculated and less impulsive decisions than men. Educate yourself about investing and take control of your portfolio. The stock market isn’t as intimidating as it seems, and there are plenty of resources to guide you.

3. “Women Should Prioritize Family Finances Over Personal Goals”

While contributing to family finances is admirable, women often sacrifice their personal financial goals in the process. It’s time to prioritize yourself. Set clear goals for your financial independence, whether that’s building a savings fund, starting a business, or investing in property. When you’re financially secure, you’re better equipped to support your family and achieve your dreams. You matter, and finances are truly an important of life. Understanding finances and prioritizing your financial need is very imperative.

4. “Always Play It Safe with Money”

The advice to avoid risks and stick to low-return financial strategies has held many women back. While it’s important to be cautious, playing it too safe can lead to missed opportunities. Don’t be afraid to take calculated risks, whether it’s investing in stocks, starting a side hustle, or exploring new financial markets. The key is to research, plan, and trust your instincts.

5. “Debt Is Always Bad”

The narrative around debt often paints it as a financial death sentence. However, not all debt is bad. Strategic borrowing, such as taking out a loan to start a business or investing in real estate, can be a powerful tool for building wealth. The key is to manage debt wisely, ensuring it aligns with your long-term financial goals and doesn’t spiral out of control.

6. “Stick to Traditional Career Paths for Stability”

Women have long been advised to choose stable, predictable careers to ensure financial security. While stability is important, it shouldn’t come at the cost of your passion or potential. Many women are finding success in entrepreneurship, freelancing, and creative fields. Don’t let fear hold you back from exploring unconventional career paths that align with your skills and passions.

7. “Don’t Talk About Money—it’s Not Polite”

Money has traditionally been a taboo topic, especially for women. This silence has perpetuated financial inequality and ignorance. Breaking this rule is essential. Talk about salaries, investments, and financial strategies with your peers. Sharing knowledge and experiences can help you make informed decisions and advocate for fair pay and opportunities.

8. “Rely on Your Partner for Financial Stability”

Women have often been encouraged to depend on their partners for financial security. While a supportive partnership is wonderful, relying solely on someone else for your financial well-being is risky. Build your own financial foundation by earning, saving, and investing independently. Financial independence is empowering and ensures you’re prepared for any life changes.

9. “Avoid Negotiating—Just Be Grateful for What You Get”

Women are frequently told to avoid negotiating, whether it’s for a salary, a promotion, or a business deal. This mindset leaves money on the table and undermines your worth. Practice the art of negotiation with confidence. Research your market value, understand your worth, and don’t settle for less than you deserve. Negotiating isn’t impolite; it’s essential.

10. “Have a Flexible Budget”

Budgets are important, but rigidly adhering to them without room for flexibility can feel suffocating. Life is unpredictable, and sometimes you need to adjust your financial plans to accommodate new opportunities or challenges. Break the rule of rigidity and embrace a dynamic budget that evolves with your needs. Flexibility allows you to adapt while still working towards your goals.

Conclusion

The Feminine Finance Revolution is about more than breaking rules—it’s about rewriting them. Women today are proving that they can be just as savvy, strategic, and successful with money as anyone else. By challenging outdated norms and embracing bold financial strategies, you can step into your power and achieve lasting wealth and independence.

Remember, financial freedom isn’t just about numbers in a bank account—it’s about the confidence, choices, and opportunities that come with it. So, break the rules, blaze your trail, and invest in the life you deserve. You’re not just managing money—you’re building an empire.

- 100 Valentine Lovers Questions - February 24, 2025

- 2025 New Year Growth Quotes - February 24, 2025

- 2025 Inspiring Self Love Quotes - February 24, 2025