10 Empowering Money Hacks for Women

Money Hacks for Women are all about smart strategies to build wealth, save efficiently, and invest confidently while maintaining a lifestyle that reflects your personal goals.

Money Hacks for Women are all about smart strategies to build wealth, save efficiently, and invest confidently while maintaining a lifestyle that reflects your personal goals.

Building wealth isn’t just about numbers—it’s about mindset, strategy, and empowerment. In today’s world, women are claiming their rightful place in the financial arena, breaking barriers, and redefining success.

Whether you’re starting from scratch or looking to level up your finances, you have the power to create a legacy that reflects your dreams and ambitions.

This guide will walk you through 10 empowering money hacks tailored for women who are ready to embrace their inner boss babe.

These tips aren’t just about making more money—they’re about taking control of your financial future with confidence and purpose..

Table of Contents

Financial Freedom Tools

Below are some to the financial freedom tools that will help in developing your financial freedom either by properly creating a budget that works for your personal style. It also includes the different strategies that will ensure your retirements goals are achievable.

Financial Budget Planner

Financial Budget Planner

It has many financial tips, trackers and and strategies to implement along the way.

- Home Finance and Bill Payment Organizer

- Budgeting Book with Income and Expense Tracker

- Daily, weekly, monthly and yearly budgets

- Bills, set annual financial goals, build a viable strategy,

.

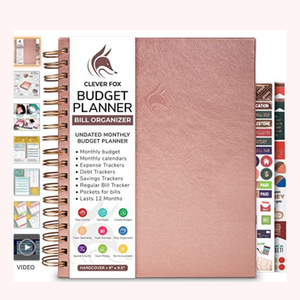

Budget Planner

Budget Planner

This is a comprehensive budget planner that is aimed in saving money and repaying debt fast

- Monthly bill organizer with pockets

- Expense tracker and finance journaling

- Financial calendar tracks money & savings,

- Debt tracking, Payment, Balances

- Bill tracking, and 2 pages for annual

.

Personal Finance Book

Personal Finance Book

This book showcases how to completely transform your finances by showing step by step strategies

- Simplified beginners guide to eliminate financial stress

- Comes with digital simplified templates to use

- Saving strategies that can quickly save money

- Debt paying strategies that will erase debt faster

- Easy Strategies to implement and track your progress

.

Payoff Debt Fast

Payoff Debt Fast

This book showcases the best way to quickly erase different types of debts.

- How to correctly payoff debt and correctly borrow money

- Includes how to manage different types of interest rates

- Credit Scores, Student Loans, Debt Payoff Strategies

- Cheaply manage debt, Essential Primer on Managing Debt

- Use credit wisely with this easy-to-understand, comprehensive guide

.

1. Master the Art of Budgeting Like a Queen

Budgeting doesn’t have to feel restrictive—it’s your ultimate power move. Start by tracking every dollar you earn and spend for a month. Use tools like Mint or YNAB to categorize your expenses and identify patterns. Once you know where your money is going, create a budget that prioritizes your goals, whether it’s saving, investing, or paying off debt. Remember, a queen doesn’t just spend—she strategizes! Set aside a “fun fund” so you can treat yourself guilt-free while staying on track...

2. Automate Your Savings and Investments

Automation is your best friend when it comes to wealth-building. Set up automatic transfers to your savings and investment accounts as soon as your paycheck hits. Treat your savings like a non-negotiable bill. Start with 20% of your income, or adjust based on your financial situation. Tools like Acorns or Betterment can help you invest spare change effortlessly. Automation ensures that your financial goals don’t get lost in the shuffle of life..

3. Embrace the Power of Multiple Income Streams

Relying on one income source is risky in today’s economy. Explore side hustles, freelance work, or passive income opportunities. Whether it’s selling digital products, renting out a spare room, or monetizing a hobby, diversifying your income is key. Start small and scale up as you grow more confident. Women who embrace multiple income streams not only secure their financial future but also create room for financial freedom..

4. Invest Early and Consistently

The earlier you start investing, the more time your money has to grow. Don’t let fear or a lack of knowledge hold you back. Start with index funds or ETFs, which are beginner-friendly and diversified. Platforms like Vanguard or Fidelity offer easy access to these options. Investing isn’t about timing the market—it’s about time in the market. Even small, consistent contributions can lead to significant growth over time..

5. Negotiate Your Worth Like a Pro

Never underestimate the power of negotiation. Whether it’s your salary, freelance rates, or business deals, always advocate for your value. Research industry standards and practice your pitch. Use platforms like Glassdoor to benchmark salaries and ensure you’re not undervaluing yourself. Remember, every dollar you negotiate compounds over time, boosting your earning potential and long-term wealth..

6. Educate Yourself About Money Management

Knowledge is power, especially when it comes to finances. Dedicate time to learning about personal finance, investing, and wealth-building strategies. Read books like Rich Dad Poor Dad by Robert Kiyosaki. Follow financial experts on social media and attend webinars or workshops. The more you know, the more confident and empowered you’ll feel in making financial decisions..

7. Leverage Tax Advantages to Maximize Wealth

Money hacks includes smart tax planning can save you thousands over time. Contribute to tax-advantaged accounts like 401(k)s, IRAs, or HSAs. If you’re self-employed, look into deductions for home offices, travel, or equipment. Consult a tax professional to ensure you’re taking advantage of every benefit available. Keeping more of your hard-earned money is a surefire way to build wealth faster..

8. Surround Yourself with a Wealth-Building Tribe

Your circle matters more than you think. Surround yourself with people who inspire and challenge you to grow financially. Join women’s financial groups or networks to share tips, resources, and encouragement. Being part of a community that values wealth-building will keep you motivated and accountable. Remember, you’re the average of the five people you spend the most time with—choose wisely

.9. Create a Vision Board for Financial Goals

Visualization isn’t just woo-woo—it’s a proven technique for success. Create a vision board that reflects your financial dreams: a debt-free life, a dream house, or a thriving business. Place it where you’ll see it daily to stay focused and inspired. Pair this with actionable steps, like monthly check-ins and progress tracking, to turn your vision into reality.

10. Prioritize Self-Care as a Financial Strategy

Wealth-building isn’t just about money—it’s about your overall well-being. Burnout can derail your financial goals, so prioritize self-care. Exercise, eat well, and take breaks to recharge. A healthy mind and body are essential for making sound financial decisions. When you feel good, you’re more likely to show up as your most productive and creative self, which directly impacts your earning potential.

Conclusion

Building wealth as a boss babe is about more than just dollars and cents—it’s about mindset, strategy, and consistency. By implementing these 10 empowering money hacks, you’re setting yourself up for long-term success and financial independence.

Remember, wealth-building is a journey, not a race. Celebrate your wins along the way, no matter how small they may seem. Each step you take is a step closer to the life you’ve always envisioned. So go ahead, boss babe—take control of your finances and own your future!

- 2025 New Year Growth Quotes - January 8, 2025

- 2025 Self Love Quotes - January 8, 2025

- 2025 New Year New Beginnings - January 8, 2025